The Central Bank

Character Size

The Central Bank

THE CENTRAL BANK

The Republican administration extended the concession period of the Ottoman Bank until 1935, as the economic situation was not suitable for establishing a new bank. However, in the agreement made, there was also a decision that the Ottoman Bank would not have the right of concession if the Government of the Republic established a new state bank that could issue banknotes. Starting from 1926, studies on the establishment of a Central Bank were started.

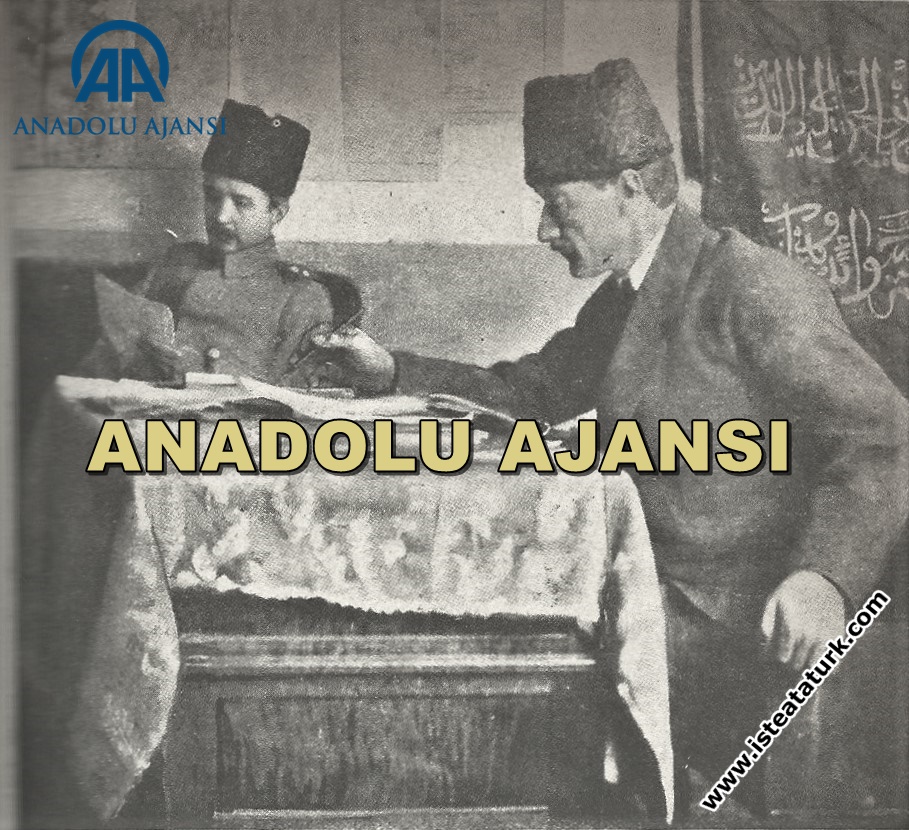

Atatürk wanted the money market to be under the control of the Turks. Despite the negative opinions of two famous Central Bankers (German Central Bank president Dr. Hjalmar Schacht, his deputy Kari Müller), whom he consulted while establishing the Central Bank, he established the Turkish Emission Bank. These experts found it inappropriate to establish an emission bank without securing monetary stability by taking certain economic and financial measures in our country. In the 1930s, according to the reports prepared by these people, the Central Bank, in the next 5 years, will maintain 30% of the banknotes in gold, 10% in foreign currency, the state budget and the balance of foreign payments, and the economy will maintain these current balances over time. It could be installed after it was strengthened. If the Central Bank was established without fulfilling these conditions, the monetary stability in the country could deteriorate and this would have very negative consequences. They were of the view that a central bank could not be established without stabilizing the Turkish currency. These were followed by the negative opinions of the French adviser (Charles Rist).one

In order to obtain the money necessary for the establishment of the Central Bank, an agreement was signed with The American Turkish Investment Corporation on 14 June 1930 regarding the monopoly of matches. With this agreement, a loan of 10 million dollars was provided at 6.5% interest. 2

Despite all these negative opinions and lack of capital, it was established on 11 June 1930 as a joint stock company with a monopoly on issuing banknotes, with more than half of the capital belonging to the state and SEEs, subject to the provisions of private law, with the law numbered 1715. 3 It started its activities in 1931. It fully started its activities on January 01, 1932.

Atatürk Central Bank was divided into 150.000 shares with a capital of 15.000.000.-TL and each worth 100 TL. These stocks are divided into four parts, (A) series to the government, (B) series to national banks, (C) series to other banks and privileged companies other than national banks, (D) series to Turkish commercial establishments and Turkish natural and legal persons. had been allocated. 4

Until the establishment of the Central Bank, paper money was circulated in our country, which was issued in the Ottoman period and became a "State Kaimesi". The Republican administration took over 158,748,563 liras of paper money from the Ottoman period. Since the monopoly of issuing banknotes was given to the Central Bank, these kaimes, which were 274,785 liras on 31 October 1933, were transferred to this bank and withdrawn from circulation. 5 The purpose of the first Central Bank in the founding law was determined as helping the economic development of the country, as stated in the second article of the law numbered 1715. In order to realize this purpose, the bank;

-To determine the rediscount rate and to regulate the money market and circulation,

-To carry out treasury transactions,

-The task of taking all measures to protect the value of the Turkish currency with the government has been given. 6

No new money was put into circulation in our country, both during the War of Independence and the period between the proclamation of the Republic and the establishment of the Central Bank. However, the amount of money in circulation has varied. In 1937, the Central Bank issued 15,563,000.-TL worth of five lira banknotes on its behalf for the first time. Thus, three types of paper money remained in circulation for a while. These;

a. Ottoman Bank banknotes with a total of 203.462 TL on 31.12.1937

b. Banknotes taken over by the Central Bank and issued during the Ottoman Empire

c. Banknotes issued by the Central Bank under its own signature and in return for purchasing gold, foreign currency and making rediscount transactions. 7

With the establishment and operation of the Central Bank, it became easier for the economic order in the country to protect itself. As a result of this, the practices of the Ottoman Bank and minority money and capital markets that were contrary to our national economic interests were ended.

1 M. Aysan, supra, p.1013; Gülten Kazgan, XXI. Turkish Economy into the Century, Istanbul 1999, p.63.

2 I. Tekeli, S. İlkin, The Formation of Statism in Turkey in Transition to Practice, Ankara 1982, p.281.

3 Gülten Kazgan, supra, p.63.

4 A. Inan, supra, p.326; I. Tekeli, S. İlkin, supra, p.294.

5 O. Akgüç, supra, p.166-167; I. Tekeli, S. İlkin, supra; p.295, Yaşar Aksoy, supra, si 17

6 I. Tekeli, S. İlkin, supra, p.294.

7 Gürgan Çelebican, Economic Policy of Atatürk Era and Turkey's Economic Development, "Money and Credit Politics and Institutionalization Movement in Atatürk Era", Ankara SBF Press School Publication, Ankara 1982, pp.30-31.

Source: Atatürk Döneminde Bankacılık Sistemine ve Gelişimine Genel Bir Bakış, Derya Bozoklu, ATATÜRK ARAŞTIRMA MERKEZİ DERGİSİ, Sayı 55, Cilt: XIX, Mart 2003